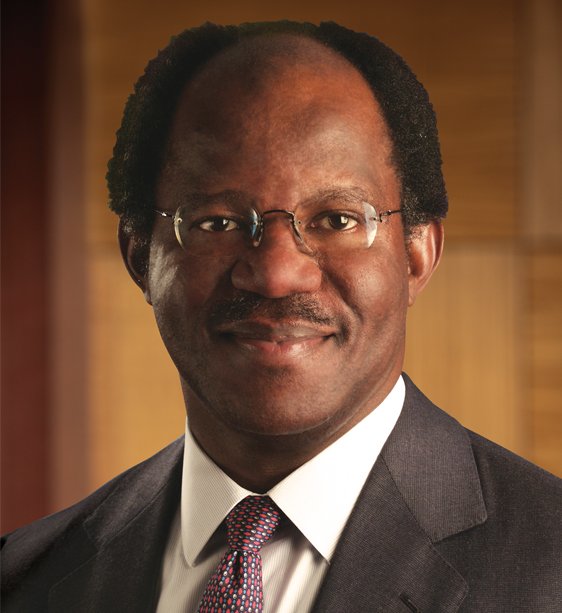

The rise of Adebayo Ogunlesi from Sagamu, Nigeria, to the commanding heights of global infrastructure finance is one of the most striking examples of African-born leadership shaping how capital and connectivity flow across continents.

From Sagamu to Wall Street

Born in 1953 in Sagamu, Ogun State, Nigeria, Adebayo Olusegun Ogunlesi grew up in an academic family—his father was the first Nigerian professor of medicine—before leaving for the United States to pursue higher education. He earned a degree from Oxford as a Rhodes Scholar. Then he completed both a JD from Harvard Law School and an MBA from Harvard Business School, placing him squarely at the intersection of law, economics and global business. Early in his career, he clerked for Justice Thurgood Marshall at the U.S. Supreme Court (1980–1981). This experience exposed him to the workings of American constitutional law before he pivoted fully into finance.

Ogunlesi joined First Boston (later Credit Suisse First Boston, CSFB), where he rose through the ranks to become Head of Global Investment Banking and later Chief Client Officer, advising governments and corporations on multi-billion-dollar transactions worldwide. This period established him as one of Wall Street’s most influential African-born bankers, trusted by sovereigns and blue-chip clients on complex privatizations and cross‑border deals.

Building Global Infrastructure Partners

In 2006, Ogunlesi co‑founded Global Infrastructure Partners (GIP), a private equity firm focused on infrastructure assets in energy, transport, digital, water and waste sectors. Under his leadership as Chairman and Managing Partner, GIP raised tens of billions of dollars across multiple funds, with its portfolio companies generating a combined annual revenue exceeding US$80 billion and holding assets on several continents. GIP quickly became one of the world’s leading independent infrastructure fund managers, known for originating proprietary transactions, conducting deep due diligence and actively managing assets for operational and environmental performance.

One of Ogunlesi’s most high‑profile moves was GIP’s acquisition of London Gatwick Airport in 2009, following the UK’s decision to break up BAA’s monopoly. GIP led a highly competitive bidding process, ultimately securing Gatwick for approximately £1.5 billion and pledging substantial investments to modernise terminals, improve baggage systems and enhance passenger experience. Over time, GIP also acquired stakes in London City Airport and Edinburgh Airport, as well as investments in ports, gas pipelines, power plants, LNG facilities and offshore wind farms, turning Ogunlesi into a central figure in the global story of how private capital is reshaping strategic infrastructure.

In 2024, BlackRock announced a US$12.5 billion deal to acquire GIP, a transaction described as one of the largest infrastructure fund acquisitions of the decade. The deal significantly increased Ogunlesi’s personal net worth—estimated in press reports at over US$2 billion—and positioned him as a senior figure in what is now one of the world’s dominant infrastructure investment platforms.

Governance roles and influence in global finance

Beyond GIP itself, Ogunlesi has held influential governance roles, deepening his impact on global markets. He serves as Lead Independent Director on the board of Goldman Sachs, where he chairs the Governance Committee and acts as an ex officio member of other key board committees. He has also served on boards such as Callaway Golf and Kosmos Energy, providing oversight on strategy, risk, and capital allocation in sectors ranging from consumer goods to oil and gas.

His expertise is widely recognised. The American Academy of Arts and Sciences elected him as a member, noting his leadership in global infrastructure investment and his earlier service as a Supreme Court law clerk. Industry and regional outlets from infrastructure trade publications to Nigerian and pan‑African media depict him as a “global infrastructure star” and a quiet multi‑sector billionaire, whose decisions influence airports, ports, energy grids and digital networks used by hundreds of millions of people.

Philanthropy, mentorship and Afrispora significance

Ogunlesi’s success has also had symbolic and practical implications for African and diaspora communities. Nigerian and African media have highlighted his visits home to mentor young entrepreneurs and professionals, and some reports have described philanthropic initiatives in education and technology hubs in Ogun State aimed at expanding opportunities for the next generation. His prominence—reinforced by popular culture references and business profiles—has made him a touchstone for narratives about African excellence in global finance, often cited alongside figures like Aliko Dangote in discussions of African billionaires with systemic impact.

From an Afrispora News perspective, Adebayo Ogunlesi represents a critical dimension of African diasporic leadership: not in multilateral diplomacy or public health, but in the capital flows and infrastructure deals that structure daily life across borders. His journey, from Sagamu to Harvard and Wall Street, from advising governments to owning and upgrading major airports, demonstrates how African-born expertise now helps set the terms on which infrastructure is financed, governed, and ultimately experienced by travellers, workers, and communities worldwide. Documenting his trajectory with clarity and historical integrity is essential to understanding how African leadership is inscribed not only in institutions such as the UN and WHO, but also in the steel, concrete, and digital networks that hold the global economy together.